The intelligent Swiss payroll software

Let KLARA take over your payroll and posting; this is automated and tax-compliant. KLARA is your online payroll programme for the electronic transmission of wage reports and withholding taxes to authorities and insurance companies.

Create payslips in no time with the click of a mouse

The many predefined types of pay make your work even easier. Send the payslips via ePost, e-mail or with Print & Send.

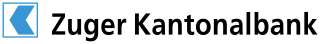

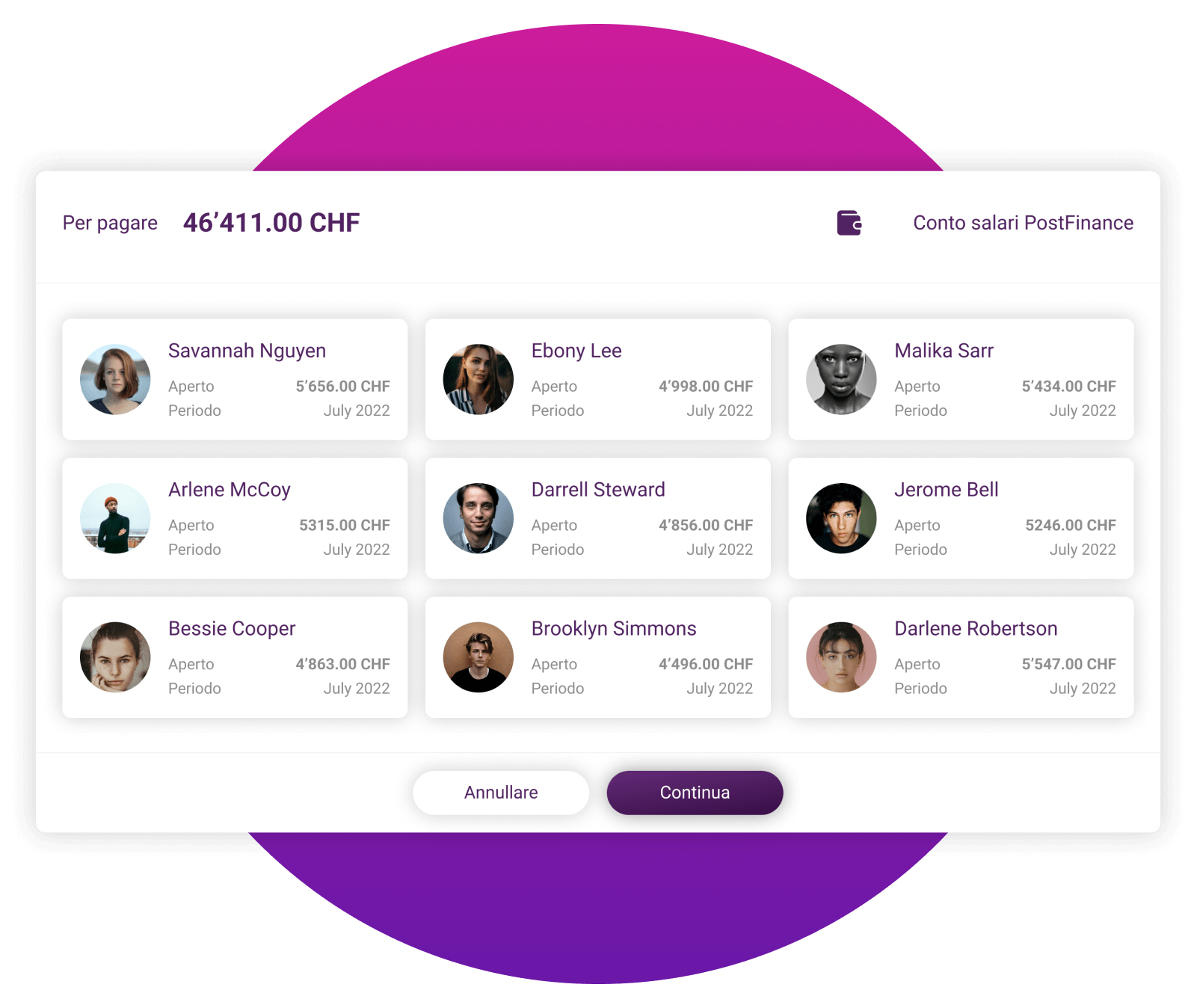

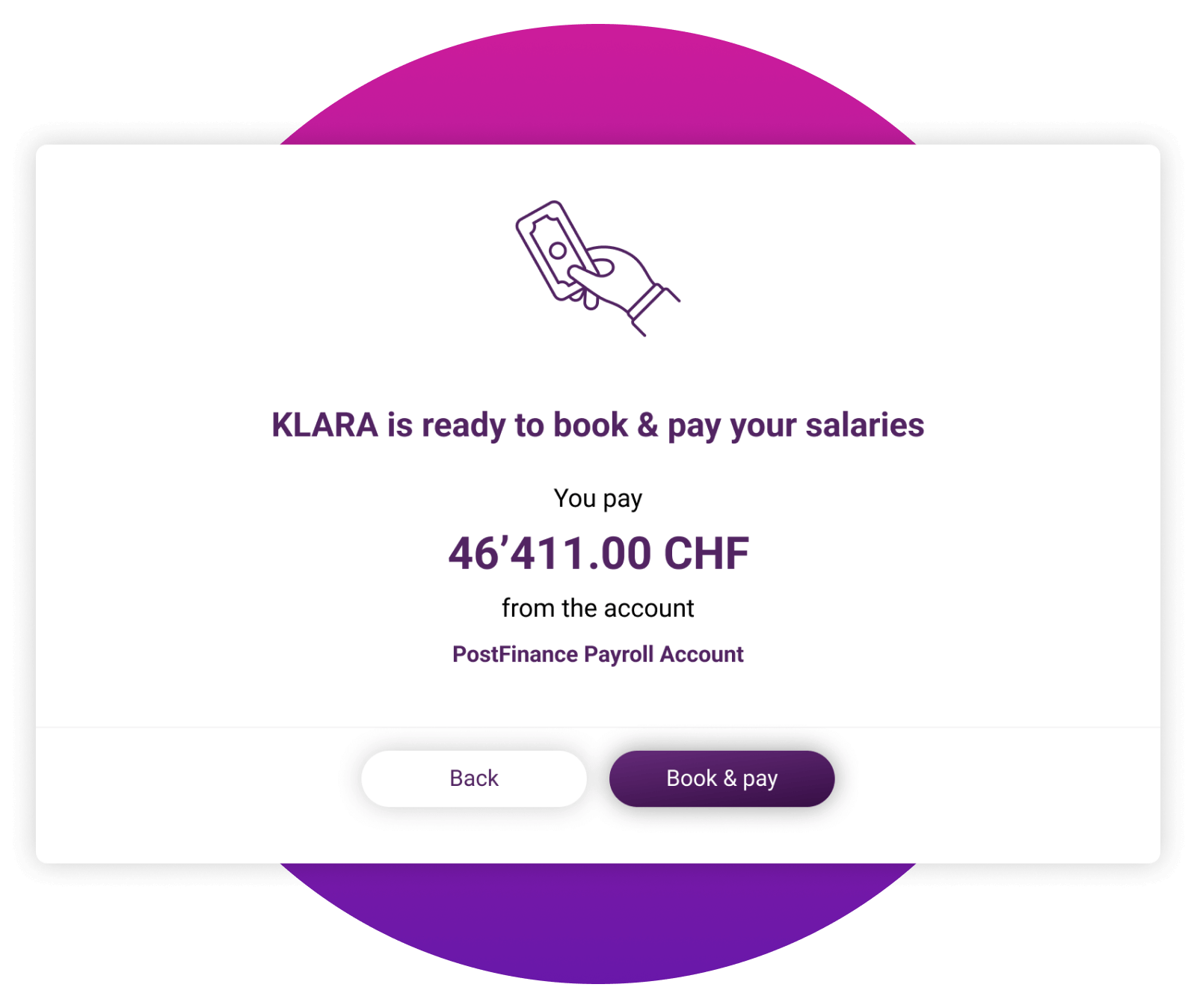

Transfer salary payments with one click

In addition to the payslips, KLARA creates payment files for upload to your online banking (ISO20022 PAIN.001).

Electronic wage reports

KLARA transmits the data electronically to all relevant authorities and insurance companies. This means no more tedious form-filling.

Further advantages to you with KLARA Payroll

Automatic posting

Create payslips intuitively

Fill in the intuitive mask and the master data is updated automatically.

Transmit withholding tax data electronically

KLARA assigns the correct withholding tax deduction and transmits the statement to the relevant authority.

What are you waiting for?

Register now and get started directly with KLARA Payroll software. If you would like a consultation, our advisors we will be happy to help you.

Re-experience your payroll accounting

With KLARA Payroll software, your employee administration is extremely straightforward – whether you are settling withholding taxes, paying wages or submitting wage reports.

The best thing of all: there are no fixed licence costs – you pay just CHF 2 per payslip.

Start now with KLARA Payroll.

All prices excl. VAT.

Payroll

The prices shown are subject to rounding differences. You can find the exact price calculation in the Widget Store.

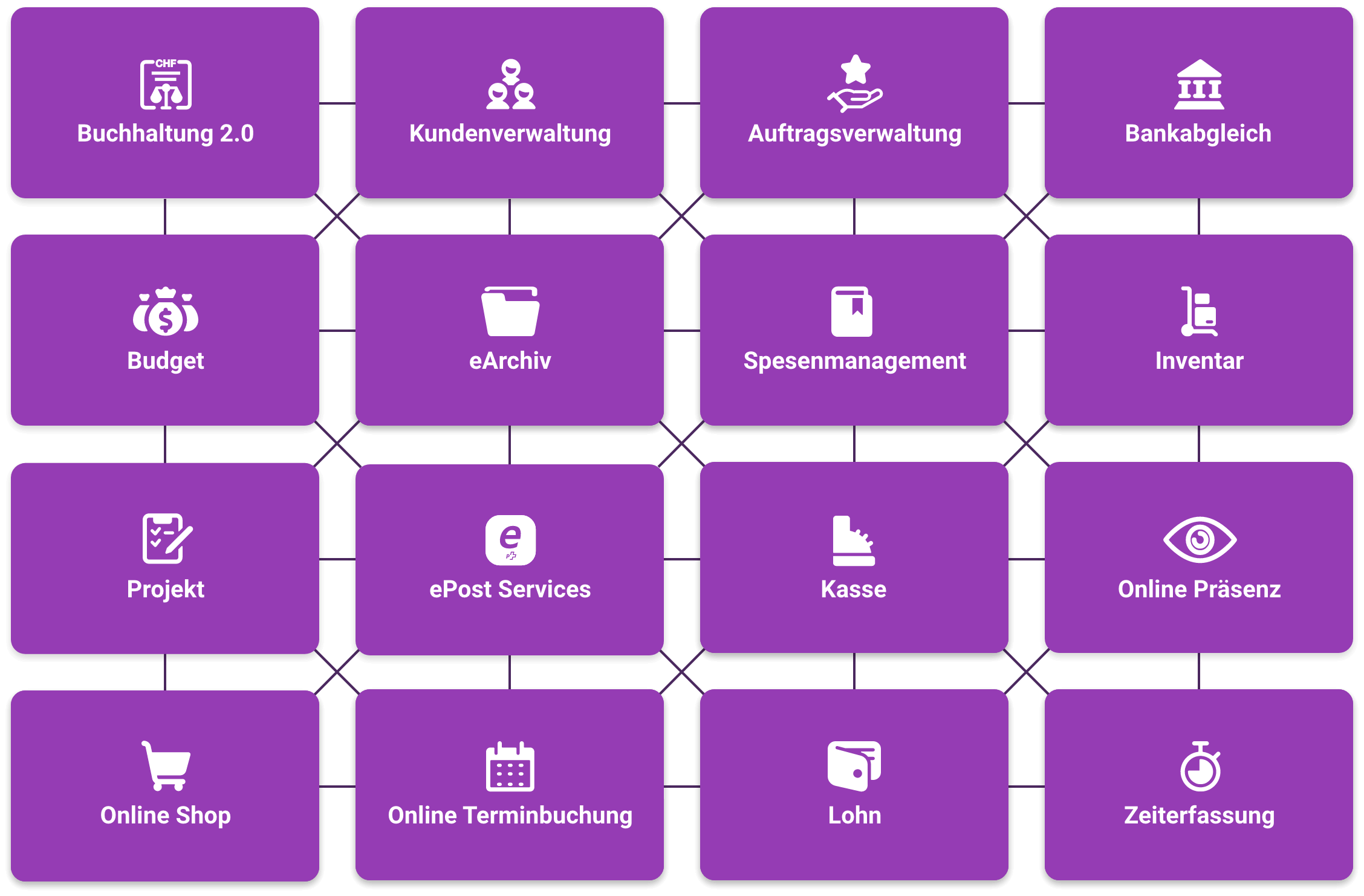

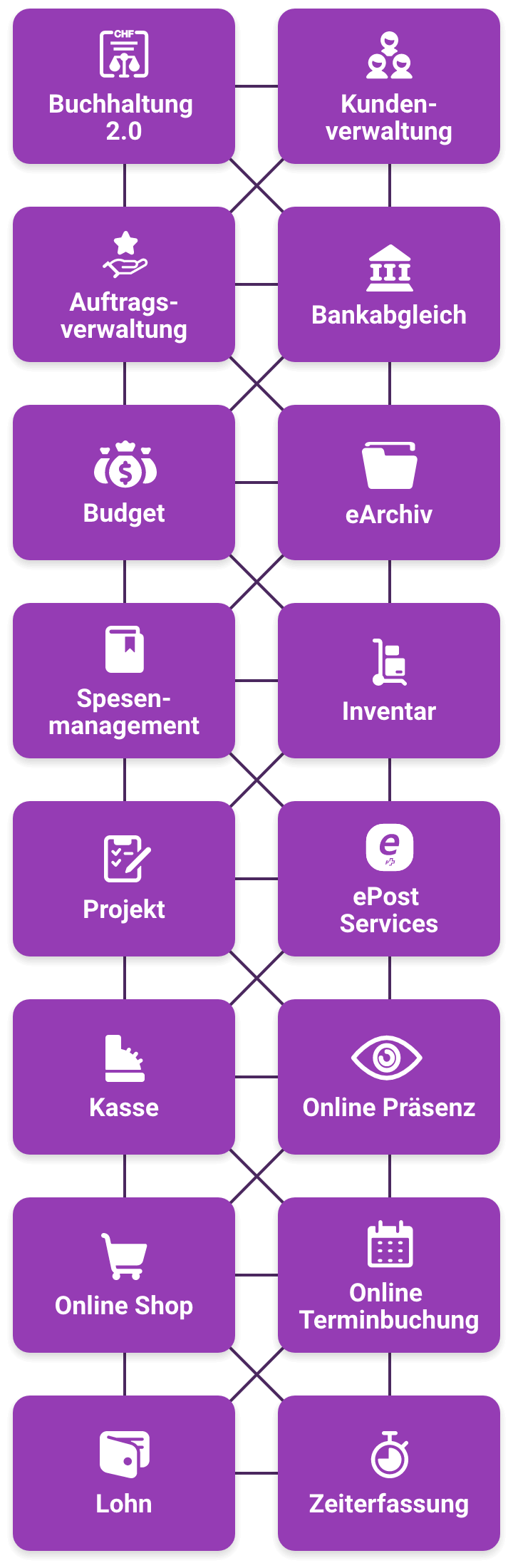

Weitere Vorteile von KLARA Business

Abos für jedes Bedürfnis

Erledige deine Büroarbeiten ruck-zuck und fehlerfrei. Das Beste daran: Unsere Lösung wächst mit deinem Unternehmen und deinen Ansprüchen mit. Füge jederzeit neue Module hinzu und profitiere von deren Zusammenspiel. Wir versprechen dir: du findest dich im Nu zurecht.

"Verkaufen war nie einfacher!"

Software:

CHF 49.-/Monat

Hardware:

CHF 1'100.-/einmalig

"Online erfolgreich mit nur einer Lösung!"

Ab CHF 29.-/Monat

Ab CHF 279.-/Jahr

"Die Administration für dein Team im Griff!"

Lohn

CHF 2.-/Monat/Mitarbeitender

Zeiterfassung

CHF 4.-/Monat/Mitarbeitender

Frequently asked questions

KLARA Payroll is a paid offer within KLARA. The basic use of KLARA Payroll is free of charge and is not linked to fixed license fees. When wage transfers are made via KLARA Payroll, an amount of CHF 2.00 is incurred for each pay advice. This is calculated in the following month based on the number of pay advices generated via the KLARA Widget Store.

Using the example of 2 employees, i.e. 2 pay slips, this means a monthly payment of CHF 4.00. In an example with 5 employees, the cost would be CHF 10.00.

KLARA is a subsidiary of Swiss Post. Our products save a lot of time on administrative tasks: a cash register that does the bookkeeping independently; an accounting system that records and posts receipts independently or a payroll accounting system, connected to the bank, which takes care of the entire payroll run with a click of the mouse, including sending the wage statements. Click here for the overview of offers.

ELM is the standardized salary reporting procedure of swissdec. It includes the annual reports to insurances, authorities and compensation funds as well as the monthly withholding tax report. KLARA is a swissdec certified wage software. This ensures that all necessary wage types are available and that the calculations in KLARA are correct.

Yes, you can correct past wage periods at any time via retroactive accounting. KLARA calculates how months should have been calculated correctly according to the new parameters and transfers a possible correction of the payment to the next wage run. With this method you do not have to worry about whether a payment has already been triggered and money has been transferred to the employee. KLARA knows all amounts that have already been paid out and knows what should be paid to your employee with the next wage calculation.

Basically you can start with the KLARA payroll accounting at any time. In order to be able to create an automatic wage statement for your employee at the end of the year, it is recommended to settle all data of a calendar year in one system. We recommend to open your payroll accounting in KLARA on January 1st of the respective calendar year. If you are in March, for example, you can map the two already settled months in KLARA.

KLARA offers you numerous ways to get answers. We distinguish between two phases.

Set up KLARA:

Under First steps we will guide you through the setup process using short videos. Furthermore, you can find out several interesting facts in our Online trainings / webinars or browse frequently asked questions and their answers in FAQs.

Support:

Don't have the time or motivation to set everything up yourself ? Then use our Setup service. Our KLARA Coaches will be happy to help you with situational support after the setup. You can also share questions and inputs via the Community or contact us using the Contact us form.

Get started with KLARA Payroll now

Simply register free of charge, get the widget and get started.

.png?width=794&name=startups-ch_Logo_RGB_Web%20(1).png)

.png?width=137&name=MicrosoftTeams-image%20(11).png)