Online accounting software for SMEs in Switzerland

KLARA offers Swiss SMEs a simple and affordable accounting solution that saves time and money: with the KLARA smartphone app, you can scan paper receipts in seconds and post them super easily with the help of artificial intelligence.

30-day free trial – ready to go in just a few minutes

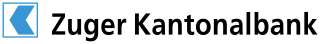

Keep an eye on your finances at all times

View automated income statements, balance sheets and account details. Whenever you want.

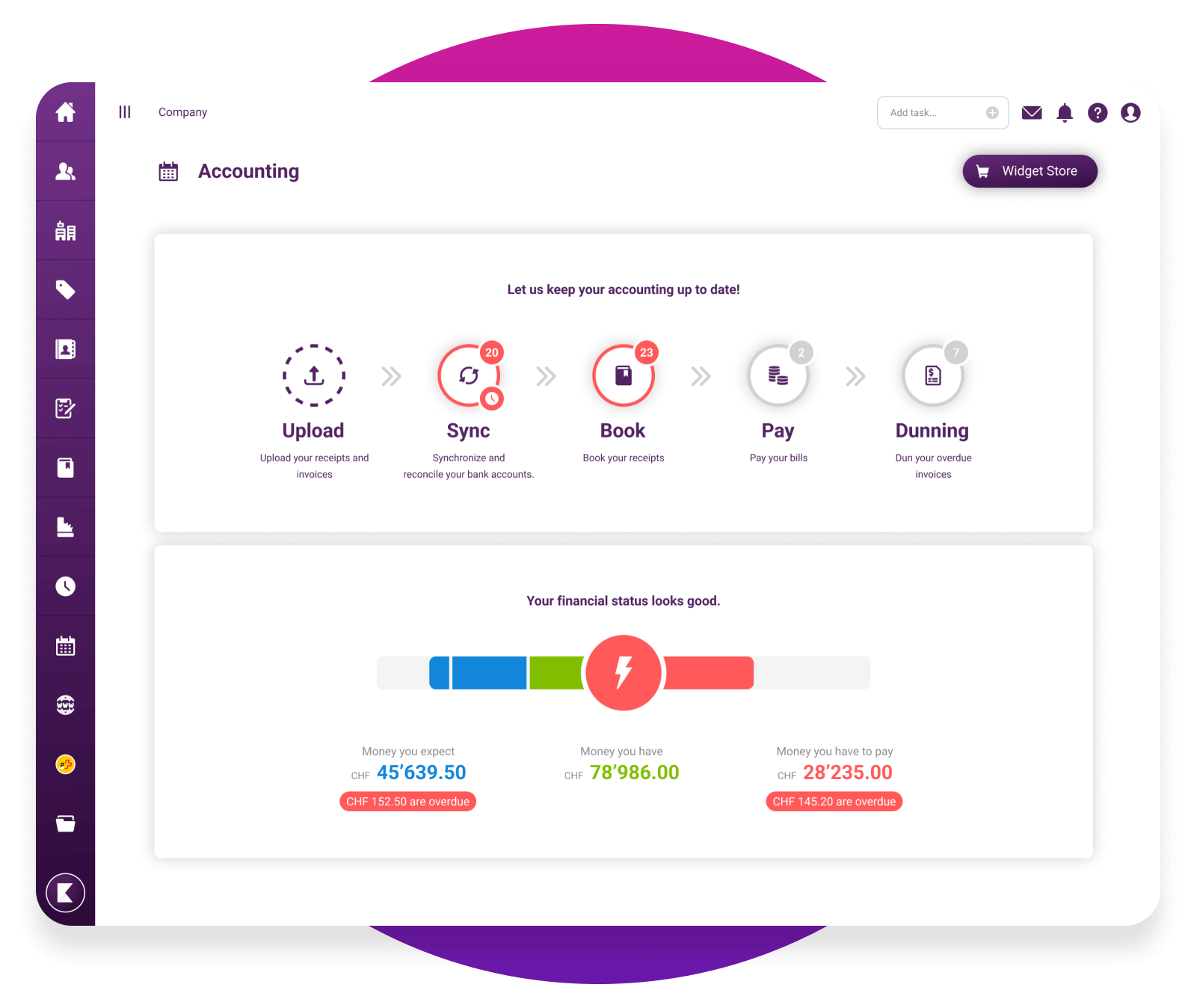

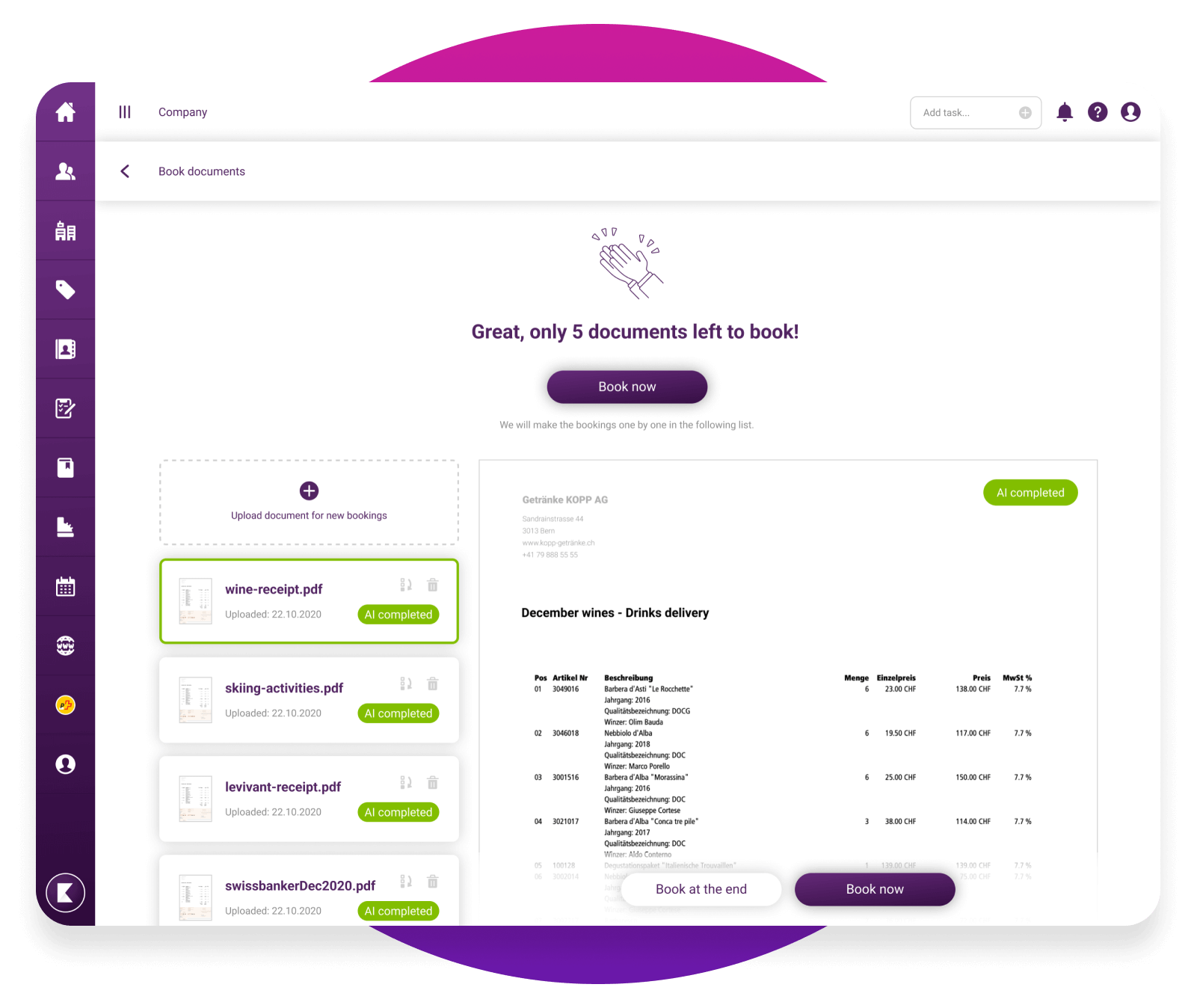

Online accounting without the need for accounting knowledge

You never have to think about charts of accounts again. It does not require familiarity with accounts systems or detailed accounting rules. KLARA knows how it works and posts your receipts almost automatically.

Automatically post incoming and outgoing payments

Thanks to its intelligent system, KLARA recognises the relevant information automatically and helps you categorise and post correctly. Your bank transactions are also reconciled in real time.

Further advantages for you with KLARA Accounting

Scan invoices on your mobile phone

Customer and supplier management included (CRM)

Order management included

These banks support automatic bank reconciliation

30-day free trial – ready to go in just a few minutes

Find the right pricing model for you

KLARA Accounting is integrated in the KLARA Business package.

Start now with KLARA Business and test 1 month for free. If you are convinced, choose between the monthly or annual subscription.

Business

STARTER

Business Starter is aimed at sole proprietorships and start-ups wishing to take their first steps in digitizing their business processes.

save 10%

save 10%

DO IT YOURSELF

for online start

Save time and effort with automated bank reconciliation. Accounting in real time with no manual data entry. Synchronise all your account activity with one click in KLARA and account for it with receipts.

Wave goodbye to outstanding invoices. Automated dunning processes enable you to keep constant track of debts owed to you and your liquidity.

Benefit from more simplicity when issuing invoices by generating recurring invoices to be sent automatically.

Accurate financial figures, all the time. Automated accruals and deferrals make accounting more precise and easier to plan.

Business

BASIC

Your company is already

successful in the market, relies on professional customer support and would like to use KLARA, for example, in cooperation with your trustee.

save 10%

save 10%

Everything from the Starter and:

Business

PLUS

The professional solution for your company, from customer management via mobile app to audit-compliant archiving of your business documents, including your personal contact person at KLARA.

save 10%

save 10%

Everything from the Basic and:

The prices shown are subject to rounding differences. You can find the exact price calculation in the widget store.

*Prices valid for: sole proprietorship, association, foundation, simple partnership

**Prices valid for: General partnership, limited partnership, public limited company, limited liability company (GmbH), cooperative

***In the context of eArchive use, additional costs for archiving per document of CHF 0.01 per month are incurred

STARTER

BASIC

PLUS

What are you waiting for?

Register now and get started directly with KLARA Business. If you would like a consultation, our advisors will be happy to help you.

Frequently asked questions

KLARA Business AG is a subsidiary of Swiss Post. KLARA stands for innovative Swiss business software for SME's, start-ups and small businesses: Our offerings include free accounting, payroll and order management as well as numerous additional fee-based offerings such as KLARA Cash Register, KLARA Online Shop and KLARA Online Booking. We want to automate as many activities as possible in the administration to make your office as simple as possible.

KLARA's accounting program handles simple and redundant activities automatically with the support of artificial intelligence (AI). These activities include automated bank reconciliation, automated import of receipts and invoices, automated management of your suppliers, and reminder and dunning assistance for delinquent customers. Thanks to automation, the accounting process is significantly simplified and requires only a minimal understanding of accounting.

With Accounting, KLARA automatically creates the VAT statement based on your VAT method (effectively or according to the balance tax rate method). You can check the statement in KLARA and prepare it for the Federal Tax Administration (FTA). You can also submit your agreed and collected VAT with Accounting.

Yes, purchases in foreign currencies can be automatically and correctly converted into Swiss francs. If a KLARA user buys something abroad, he can upload his receipt in KLARA. KLARA analyzes the receipt and recognizes as usual the supplier, the receipt date, the payment amount and other information. Likewise, KLARA automatically fetches the official conversion rate from the Swiss Federal Customs Administration and converts the amount into Swiss francs.

KLARA offers you numerous ways to get answers. We distinguish between two phases.

Set up KLARA:

Under First steps we will guide you through the setup process using short videos. Furthermore, you can find out several interesting facts in our Online trainings / webinars or browse frequently asked questions and their answers in FAQs.

Support:

Don't have the time or motivation to set everything up yourself ? Then use our Setup service. Our KLARA Coaches will be happy to help you with situational support after the setup. You can also share questions and inputs via the Community or contact us using the Contact us form.

Get started with KLARA Business now

Simply register free of charge, get the widget and get started.

.png?width=794&name=startups-ch_Logo_RGB_Web%20(1).png)

.png?width=137&name=MicrosoftTeams-image%20(11).png)